Business

Business Computing World: How Modern Firms Run on Tech

Introduction

The business computing world is no longer a quiet back-office function. It’s the nervous system of modern companies, shaping how decisions get made, how money moves, and how fast organizations can adapt when the market punches back. From cloud platforms to data-driven strategy, computing now determines whether a business scales or stalls. This article breaks down what the business computing world really is, how it evolved, and why understanding it is no longer optional if you want to compete, lead, or even stay relevant. You’ll learn the core components, real-world use cases, common failures, and where things are heading next—without fluff or recycled clichés.

What the Business Computing World Actually Means

The business computing world refers to the technologies, systems, and practices organizations use to run operations, manage information, and make decisions. This includes hardware, software, networks, data systems, and the people who design and manage them. It’s not just “IT.” That outdated label misses the point.

Computing in business exists to reduce friction. Every invoice processed, shipment tracked, or forecast generated is a computing task. When these systems work well, businesses move faster with fewer errors. When they don’t, chaos shows up as delays, bad decisions, and wasted money.

The mistake many leaders make is treating computing as a cost center. In reality, it’s a leverage center. Done right, it multiplies human effort. Done poorly, it quietly drains margins until the company bleeds out.

A Short Evolution of Business Computing

From Mainframes to Distributed Systems

Early business computing lived on massive mainframes locked in climate-controlled rooms. Only specialists touched them. Processing was slow, expensive, and centralized, but it was revolutionary for accounting and payroll.

As personal computers entered offices, computing power spread across departments. This boosted productivity but introduced fragmentation. Data lived in silos, and compatibility became a mess.

The Internet and Networked Enterprises

Networking changed everything. Systems began talking to each other. Supply chains connected digitally. Email replaced memos. Companies started acting like integrated organisms instead of isolated departments.

This shift laid the groundwork for today’s business computing world, where speed and integration matter more than raw processing power.

Core Pillars of the Business Computing World

Hardware Infrastructure

Despite all the talk about software, physical hardware still matters. Servers, employee devices, networking equipment, and storage systems form the backbone of operations. Poor hardware choices create bottlenecks that no clever software can fully fix.

Smart organizations standardize hardware where possible. They plan lifecycle replacements instead of waiting for failures. This reduces downtime and keeps performance predictable.

Software Systems That Run the Business

Software is where most business logic lives. Accounting platforms, customer management systems, project tools, and analytics engines define how work actually gets done.

The key problem isn’t lack of options. It’s excess. Companies often stack overlapping tools without clear ownership. The result is confusion, duplicated data, and rising costs with little added value.

Data as a Strategic Asset

Data is the most abused term in business computing. Collecting data is easy. Using it well is hard. The business computing world treats data as something to be governed, cleaned, and interpreted, not hoarded.

High-performing firms design systems around decision-making. They don’t ask, “What data can we collect?” They ask, “What decision needs to be better?”

Major Platforms Shaping Modern Business Computing

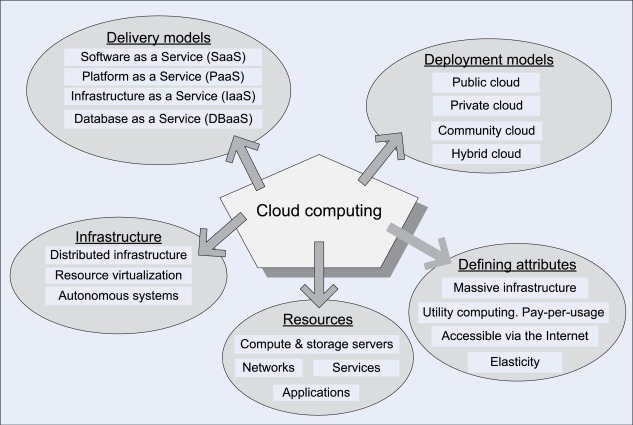

Early in any serious discussion, it helps to understand the major platforms organizations rely on today.

Key Business Computing Platforms

| Platform | Primary Role | Typical Business Use |

| Enterprise Servers | Central processing | Financial systems, internal apps |

| Cloud Platforms | Scalable computing | On-demand workloads, global access |

| Business Software Suites | Process management | Finance, HR, operations |

| Data Platforms | Analysis and reporting | Forecasting, performance tracking |

Major providers like IBM, Microsoft, and Amazon Web Services have shaped how these platforms are delivered, priced, and maintained across industries.

The Business Computing World and Decision-Making

This is where theory meets reality. Computing doesn’t create value by existing. It creates value by improving decisions.

Consider pricing. A retailer adjusting prices weekly based on historical sales will always lose to one adjusting daily using live demand signals. The computing difference isn’t subtle; it’s existential.

Good systems shorten feedback loops. They surface problems early. They let leaders test assumptions with evidence instead of gut feelings. Bad systems bury insights under noise and delay.

If your computing setup can’t answer basic questions quickly, it’s not “good enough.” It’s broken.

Real-World Case: Scaling Without Breaking

A mid-sized logistics firm once handled routing manually using spreadsheets. Growth exposed the limits fast. Errors increased. Customers complained. Margins shrank.

By redesigning their computing approach—integrating routing software, real-time tracking, and automated billing—they didn’t just fix problems. They unlocked scale. Headcount stayed flat while revenue doubled.

This is the business computing world at work. Not flashy. Just brutally effective.

Security and Risk in Business Computing

Every system creates risk. The more connected a company becomes, the more exposed it is.

Security failures in business computing rarely come from Hollywood-style hacks. They come from weak controls, outdated systems, and human shortcuts. Password reuse. Unpatched software. Overly broad access rights.

The fix isn’t paranoia. It’s discipline. Clear ownership. Regular audits. Designing systems so mistakes don’t cascade into disasters.

Security is not a feature you bolt on. It’s a design principle you either respect or pay for later.

Comparing Traditional and Modern Business Computing

| Aspect | Traditional Approach | Modern Approach |

| System Location | On-site only | Hybrid and remote-ready |

| Scalability | Slow and costly | Rapid and flexible |

| Data Access | Restricted | Role-based, real-time |

| Decision Speed | Lagging | Near-instant |

Companies clinging to older models often claim stability. What they really have is inertia.

People: The Most Ignored Component

Technology doesn’t fail alone. People fail with it.

The business computing world depends on users understanding systems well enough to trust them, challenge them, and improve them. Training is often the first thing cut and the last thing replaced.

That’s shortsighted. A powerful system used poorly is worse than a simple system used well. Smart organizations invest in literacy, not just licenses.

Common Myths That Hold Businesses Back

Here are two ideas that deserve to die:

- “We’re not big enough to need serious computing.”

- “Once it’s set up, we’re done.”

Size doesn’t protect you from complexity. Growth exposes it. And computing systems decay if they aren’t actively maintained and questioned.

The business computing world is dynamic. Treating it as static is a strategic error.

Where the Business Computing World Is Heading

Computing is moving closer to the decision-maker. Interfaces are simplifying. Automation is handling routine work. Systems are becoming more predictive instead of reactive.

This doesn’t mean fewer people. It means different roles. Less manual processing. More oversight, judgment, and strategy.

Companies that adapt early will feel like they’re cheating. The rest will blame the market.

Conclusion

The business computing world is not a trend, a department, or a buzzword. It’s the operational reality of modern business. It determines how fast you learn, how well you execute, and how resilient you are under pressure.

Organizations that treat computing as strategic infrastructure gain clarity, speed, and leverage. Those that treat it as background noise accumulate hidden risks and inefficiencies.

The takeaway is simple but uncomfortable: if your systems can’t clearly support better decisions, they’re costing you more than money. Audit them. Question them. Improve them. The business computing world rewards discipline and punishes complacency—every single time.

Frequently Asked Questions (FAQs)

What is meant by the business computing world?

It refers to the full ecosystem of technologies and systems businesses use to operate, manage data, and support decision-making across all functions.

Is business computing only relevant for large companies?

No. Smaller firms often benefit more because smart systems let them scale without proportional increases in cost or staff.

How does business computing affect daily operations?

It shapes how work flows, how quickly issues are identified, and how reliably tasks are completed across departments.

What’s the biggest mistake companies make with business computing?

Treating it as a one-time setup instead of an evolving capability that needs ongoing attention and improvement.

How can a company assess its current computing setup?

By measuring how quickly it can answer critical questions, adapt to change, and recover from errors without chaos.

Business

Kwasi Kwarteng Net Worth: A Deep Dive into His Wealth, Career, and Financial Power

Introduction

Kwasi Kwarteng is not just another British politician with a respectable résumé. He is a high-profile figure whose rapid rise, dramatic fall, and financial standing continue to attract attention. People searching for kwasi kwarteng net worth are not just curious about numbers; they want to understand how power, policy decisions, and personal finances intersect. This article breaks down his earnings, assets, and income sources in plain English, without hype or political spin. If you expect billionaire-level wealth, reset your expectations now. His net worth reflects a professional political life, not elite corporate dominance. Understanding that distinction matters if you want a realistic picture rather than internet fantasy.

Who Is Kwasi Kwarteng?

Kwasi Kwarteng is a British Conservative Party politician known for his sharp intellect, classical education, and controversial time as Chancellor of the Exchequer. Born in 1975 to Ghanaian parents, he built his reputation through academic excellence before entering politics. He studied at Eton College and later at Cambridge University, where he earned a PhD in economic history. That academic background gave him credibility, but credentials alone do not translate into wealth. His public image combines elite education with ideological confidence, which helped him rise quickly. However, politics in the UK is not a fast track to massive personal riches, and his career reflects that reality clearly.

Kwasi Kwarteng’s Political Career and Income

Kwasi Kwarteng’s primary income source has always been politics. As a Member of Parliament, his base salary followed UK parliamentary standards, which are public and tightly regulated. When he served as Chancellor of the Exchequer in 2022, his salary increased, but not dramatically by global executive standards. Even at the top of UK government, pay remains modest compared to corporate leadership roles. This matters when estimating kwasi kwarteng net worth, because his income ceiling is structurally limited. Unlike politicians in countries with looser financial oversight, UK ministers face strict disclosure rules. His career brought influence and visibility, but not exponential wealth growth.

Estimated Kwasi Kwarteng Net Worth in 2025

As of 2025, estimates place kwasi kwarteng net worth between £1 million and £2 million. That range reflects cumulative earnings from his parliamentary salary, ministerial roles, book royalties, and possible investment income. This is comfortable wealth, not extreme affluence. Anyone claiming he is worth tens of millions is either misinformed or deliberately exaggerating. The figure aligns with long-term public service combined with intellectual side income. Importantly, his net worth has likely stagnated or declined slightly since leaving high office, due to reduced salary and reputational impact. Wealth preservation, not rapid accumulation, is now the more accurate financial narrative.

Book Deals, Writing, and Intellectual Income

Outside politics, Kwasi Kwarteng has earned money through writing and publishing. He co-authored and authored several books focused on British history, politics, and economics. These books enhance his authority and visibility, but they are not blockbuster sellers. Academic and political books typically generate steady but modest royalties. Still, this income stream adds diversification to kwasi kwarteng net worth. More importantly, it reinforces his positioning as a serious thinker rather than a career opportunist. If he continues writing or transitions into speaking engagements, this intellectual capital could become a more significant revenue source over time.

Investments, Assets, and Property Holdings

Kwasi Kwarteng is not known for flashy assets or aggressive investing. Public disclosures suggest standard holdings: pension contributions, savings, and possibly residential property. UK politicians are required to declare financial interests, which limits hidden wealth accumulation. There is no evidence of offshore accounts, speculative trading, or large private equity involvement. This conservative financial profile supports the estimated kwasi kwarteng net worth range. In simple terms, his money works slowly and safely, not aggressively. That may sound boring, but it aligns with both legal constraints and his public ideological stance on fiscal responsibility.

Controversies and Their Financial Impact

The 2022 mini-budget crisis severely damaged Kwasi Kwarteng’s political standing. While controversy does not directly erase existing wealth, it affects future earning potential. Speaking fees, advisory roles, and board opportunities often depend on reputation. His abrupt dismissal as Chancellor limited post-office financial upside. This is a key factor people overlook when discussing kwasi kwarteng net worth. Political missteps have real financial consequences, especially in reputational economies like consulting and publishing. Anyone assuming his wealth surged after office is ignoring how credibility drives long-term income opportunities.

Comparison with Other UK Politicians

Compared to peers, Kwasi Kwarteng’s wealth is average. He is not among the richest UK politicians, nor is he financially struggling. Figures like Rishi Sunak or former prime ministers with private-sector backgrounds operate on a different financial scale entirely. This comparison matters because it contextualizes kwasi kwarteng net worth realistically. His wealth comes from public service and intellectual labor, not hedge funds or inherited capital. If you’re measuring success purely by net worth, he does not rank at the top. If you measure influence and visibility, the picture changes—but money and power are not the same thing.

Future Earning Potential and Financial Outlook

Looking ahead, Kwasi Kwarteng’s financial future depends on reinvention. If he rebuilds credibility through writing, policy research, or international speaking, his income could stabilize or grow modestly. If he fades from public relevance, earnings will likely plateau. There is no realistic path to explosive wealth unless he pivots fully into private-sector advisory work. Therefore, future kwasi kwarteng net worth projections should remain conservative. Expect stability, not spectacular growth. That’s the honest assessment, not the clickbait version.

Conclusion

Kwasi Kwarteng’s financial story is far more grounded than online speculation suggests. His net worth reflects a long career in public service, supported by intellectual work and modest investments. The current estimates for kwasi kwarteng net worth show comfort, not excess. Understanding this helps separate political mythology from financial reality. If you’re looking for lessons, here’s the blunt takeaway: elite education and high office do not guarantee massive wealth. In the UK system, power brings responsibility and scrutiny, not unchecked financial gain. That reality defines his financial legacy more than any headline ever will.

Frequently Asked Questions (FAQs)

1. What is Kwasi Kwarteng’s net worth in 2025?

Kwasi Kwarteng’s net worth in 2025 is estimated between £1 million and £2 million. This includes political salaries, book royalties, pensions, and standard investments. It does not indicate extreme wealth or billionaire status.

2. How did Kwasi Kwarteng make his money?

He made his money primarily through his salary as an MP and cabinet minister, supplemented by income from publishing books and academic work. There is no evidence of major business ventures or corporate windfalls.

3. Did serving as Chancellor make him rich?

No. While the Chancellor role paid more than a standard MP salary, it was short-lived and tightly regulated. The position increased visibility, not long-term wealth.

4. Does Kwasi Kwarteng own significant property or assets?

Public disclosures suggest standard property and pension holdings, not large-scale real estate portfolios or luxury assets. His financial profile is relatively conservative.

5. Can Kwasi Kwarteng’s net worth grow in the future?

Yes, but only modestly. Future growth depends on writing, speaking, or advisory roles. Without a major private-sector pivot, dramatic wealth increases are unlikely.