Blogs

Clarivate Share Price: A Complete Guide for Investors in 2025

Introduction

The Clarivate share price has become a topic of growing interest as more investors explore information-based companies in today’s data-driven economy. Whether you’re a new investor or someone tracking long-term opportunities, understanding how a company like Clarivate moves in the market can help you make smarter decisions. This guide breaks down everything you need to know—trend behavior, key influences, market developments, and what might shape future performance—all explained in clear, simple language while helping you stay ahead of ongoing market changes.

What Makes the Clarivate Share Price Important for Investors?

The Clarivate share price is important to investors because it reflects both the company’s earnings potential and the value of its intellectual-property-focused services. As a provider of analytics, data solutions, and research tools for global organizations, Clarivate sits at the center of industries that rely on accurate, trustworthy information. Investors watch this price closely because it offers insight into how the market perceives the company’s long-term competitiveness. When the business shows improved revenue, new partnerships, or technological advancements, the share price often responds positively. However, shifts in the broader technology and analytics sector can also influence movements, reminding investors that market trends extend beyond a single company.

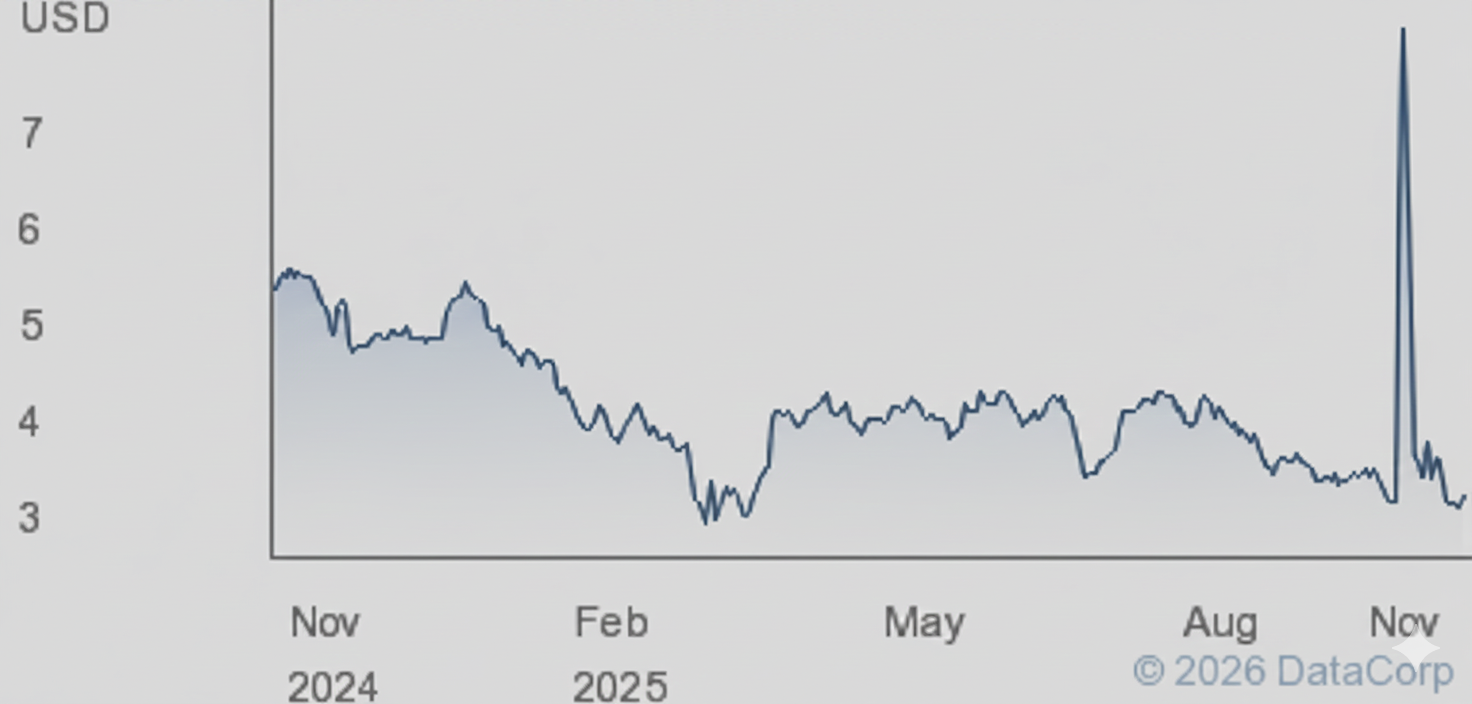

Historical Behavior of the Clarivate Share Price and Why It Matters

Looking at how the Clarivate share price has performed historically helps investors understand patterns, volatility, and potential strengths. Over the years, the company has experienced various cycles driven by corporate acquisitions, restructuring efforts, and strategic investments in digital data tools. These historical phases show that the share price often reacts significantly to leadership changes and updates to financial forecasts. By reviewing past movements, investors gain a clearer picture of how the market typically responds to both positive announcements and challenges. Understanding these past trends provides a foundation for evaluating future expectations while staying aware of how external economic pressures can shape performance.

Key Factors That Influence the Clarivate Share Price Today

Several important factors impact the Clarivate share price, and staying aware of them can help investors make more informed decisions. First, earnings reports play a major role, as strong quarterly results often boost investor confidence. Second, the company’s involvement in research, patents, and analytics means that demand from scientific, legal, and academic institutions directly affects growth. Third, competition in the data-intelligence industry also influences price trends, especially when new technologies emerge. Finally, broader financial conditions—such as interest rates, inflation, and investor sentiment toward tech-driven companies—can contribute to market fluctuations. Altogether, these factors show that Clarivate’s position is connected to both industry-specific developments and larger economic conditions.

How Global Market Trends Shape the Clarivate Share Price

Global market conditions can have a strong impact on the Clarivate share price because the company serves customers worldwide. When international organizations increase their investment in research tools, digital transformation, or intellectual property protection, the demand for Clarivate’s services often grows. Conversely, during periods of economic slowdown, budgets for analytics or research tools may tighten, affecting revenue growth. Technology adoption rates, shifts toward automation, and increased reliance on verified data also play a role in shaping investor expectations. As a global company, Clarivate’s market value is influenced not only by U.S. economic trends but also by international developments, making global awareness essential for investors.

How Company Strategy and Innovation Affect the Clarivate Share Price

Company strategy—especially innovation—holds a major influence over the Clarivate share price. When Clarivate invests in new technologies, enhances its platforms, or updates its data capabilities, these improvements often encourage investors to view the company as more competitive. Partnerships with research institutions or high-growth industries can also increase market confidence. Similarly, restructuring plans intended to simplify operations or reduce costs may create positive expectations for future earnings. Still, innovation strategies come with risks, and the market may react negatively if execution is slow or if expenses outweigh projected benefits. Understanding the balance between innovation and financial discipline is key to analyzing price potential.

Investor Sentiment and Market Confidence Around the Clarivate Share Price

Investor sentiment plays a powerful role in shaping the Clarivate share price because markets often react to expectations rather than just financial results. When analysts issue favorable outlooks or when Clarivate releases promising updates, investor confidence may rise, leading to increased buying activity. On the other hand, concerns about long-term growth, industry competition, or company debt can create caution among investors. Market confidence can also be influenced by external events like regulatory changes or technological disruptions. Keeping an eye on the emotional side of investing is essential, as sentiment often drives short-term price behavior even when long-term fundamentals remain stable.

What New Investors Should Know Before Tracking the Clarivate Share Price

New investors should understand a few key points before tracking the Clarivate share price. First, it’s important to learn how the company generates revenue and what industries rely heavily on its services. Clarivate works with sectors where accuracy is essential, so long-term demand remains strong. Second, new investors should consider the company’s past volatility and how its share price responds to financial updates. Third, it helps to follow major industry trends, such as digital transformation or intellectual-property research, which directly influence growth potential. With these basics in mind, beginners can evaluate opportunities more confidently and avoid decisions based on short-term market noise.

Future Outlook: What Could Influence the Clarivate Share Price Next?

Several future developments may influence the Clarivate share price as the market continues to evolve. Advancements in AI-powered analytics, increased global demand for data verification, and policy changes related to intellectual property are all areas worth watching. If Clarivate continues expanding its digital solutions or entering new markets, these moves could strengthen long-term investor confidence. Future earnings guidance, improved financial management, or successful integration of new technologies may also play supportive roles. At the same time, competition, regulatory updates, and global economic uncertainty could challenge price stability. Keeping track of these potential drivers helps investors prepare for upcoming market shifts.

Conclusion

The Clarivate share price remains an important focus for investors who want to understand market behavior within the data and research-analytics industry. By examining historical trends, industry influences, strategic decisions, and future expectations, investors can build a clearer picture of how the company might perform moving forward. While no market prediction is ever perfect, staying informed about global trends, company updates, and technological changes can make a meaningful difference. With the right insights, both new and experienced investors can approach Clarivate with greater clarity and confidence as they navigate today’s dynamic financial landscape.

Blogs

Patrick Christys Net Worth: Career, Salary, Income Sources, and Financial Growth Explained

Introduction

People searching for patrick christys net worth aren’t looking for gossip—they want numbers, context, and credibility. Patrick Christys is a visible media figure, and visibility naturally raises questions about money. This article breaks down what is actually known, what can be reasonably estimated, and what claims are pure speculation. No hype, no fluff. You’ll get a clear look at his career path, earnings, assets, and financial outlook, using realistic assumptions based on the UK media industry.

Who Is Patrick Christys?

Patrick Christys is a British journalist, political commentator, and television presenter best known for his work with GB News. He built his reputation through sharp commentary, direct language, and a confrontational interview style. Unlike celebrities who go viral overnight, Christys followed a traditional media path—radio, journalism, then television. That matters, because traditional media careers usually produce steady income, not sudden massive wealth.

His public persona is outspoken, but his career progression is methodical. That combination makes people overestimate his finances. Fame does not automatically equal millions. Understanding his background is essential before judging his net worth realistically.

Patrick Christys Career Journey and Media Background

Christys began in radio journalism, including work at talkRADIO, where he developed his on-air presence. Radio pays modestly compared to television, but it builds credibility. His transition to GB News marked the biggest financial step in his career. GB News presenters earn more than radio hosts, but far less than BBC or ITV prime-time stars.

This career path suggests gradual income growth rather than explosive wealth. He didn’t launch a startup, inherit money, or sell a company. His earnings come from media contracts, appearances, and commentary—predictable, taxable, and limited by market rates.

Patrick Christys Net Worth: Estimated Figures Explained

Let’s be blunt: there is no verified public figure for Patrick Christys’ net worth. Any site claiming an exact number is guessing. Based on UK television presenter salaries, industry averages, and his career length, most realistic estimates place patrick christys net worth between £300,000 and £700,000.

That range reflects income accumulation over time, not luxury wealth. He is financially comfortable, not ultra-rich. If you expected multi-million figures, that assumption ignores how UK media salaries actually work—especially at newer networks like GB News.

How Patrick Christys Makes His Money

Patrick Christys earns income through several straightforward channels. His primary source is his television presenting salary from GB News. Secondary income comes from radio work, paid appearances, guest commentary, and possibly freelance journalism. Some presenters also earn from speaking events, but those fees are modest unless you’re a household name.

There is no evidence of major business investments, brand empires, or high-revenue side ventures. That’s not a weakness—it’s normal. His income structure is stable but capped, which keeps patrick christys net worth grounded in reality rather than inflated fantasy.

Salary at GB News and Industry Comparisons

GB News salaries vary widely. Senior prime-time hosts can earn six figures, while newer or mid-tier presenters earn less. Industry insiders estimate Christys’ annual salary between £80,000 and £150,000. That’s strong income by UK standards but not elite.

Compare that to BBC stars earning £300,000+ annually, and the gap becomes obvious. GB News is a growing network, not a legacy giant. Expecting massive paydays ignores business scale, advertising revenue, and audience size.

Lifestyle, Assets, and Spending Habits

Christys does not display an extravagant lifestyle. No supercars, no public luxury property portfolio, no high-end brand flexing. That suggests disciplined spending or simply average tastes. Either way, it aligns with his estimated wealth.

A presenter at his level likely owns or rents property in or around London, possibly has savings and pension investments, and maintains a professional lifestyle. That’s sensible, not flashy. Lifestyle restraint is one reason patrick christys net worth is likely stable and growing slowly.

Is Patrick Christys’ Net Worth Growing?

Yes—but incrementally. Media careers reward longevity and consistency. If Christys stays visible, avoids controversy that leads to contract loss, and expands into digital platforms or podcasts, his income could rise. However, exponential growth would require either mainstream crossover or independent monetization.

Right now, his financial trajectory is steady, not explosive. Anyone predicting sudden multi-million status is ignoring how slow and competitive British media actually is.

Public Perception vs Financial Reality

Here’s the uncomfortable truth: people confuse influence with wealth. Being loud, viral, or polarizing does not mean being rich. Patrick Christys is influential within a niche audience, not a mass-market entertainment brand.

That distinction matters. Patrick christys net worth reflects professional success, not celebrity excess. If you want accuracy, drop assumptions and follow the economics.

Conclusion

Patrick Christys is financially successful by normal standards, not celebrity fantasy standards. His estimated net worth sits comfortably in the mid-six-figure range, built through consistent media work rather than dramatic windfalls. He earns well, spends sensibly, and operates within the limits of the UK broadcasting market. If his career continues upward, so will his wealth—but slowly, realistically, and without overnight miracles.

FAQs About Patrick Christys Net Worth

What is Patrick Christys’ net worth in 2025?

There is no official figure, but realistic estimates place Patrick Christys’ net worth between £300,000 and £700,000 based on salary history, media roles, and industry averages.

How does Patrick Christys make his money?

He earns primarily from television presenting at GB News, along with radio work, guest appearances, and possible freelance journalism or speaking engagements.

Is Patrick Christys a millionaire?

There is no evidence supporting millionaire status. Claims suggesting otherwise ignore UK media salary structures and lack factual backing.

Does Patrick Christys have other businesses?

No verified information suggests he owns major businesses or investment ventures. His income appears media-based and straightforward.

Will Patrick Christys’ net worth increase in the future?

Likely yes, but gradually. Long-term visibility, audience growth, and platform expansion—not hype—will determine future financial growth.

Blogs

Discover Nekopopi.care: Your Ultimate Guide to High-Quality Cat Care Products and Services

Introduction

As a pet owner, ensuring that your cat lives a healthy and comfortable life is a top priority. Finding the right products and services to care for your furry companion can sometimes feel overwhelming, but that’s where nekopopi.care comes in. With a wide selection of high-quality cat care items, Nekopopi.care is your one-stop shop for everything your cat needs to thrive.

In this article, we’ll dive into what makes nekopopi.care stand out from other cat care providers, the types of products they offer, and how they’re dedicated to providing top-tier solutions for your feline’s health and happiness. Whether you’re a new cat owner or an experienced pet parent, you’ll discover why Nekopopi.care is a must-visit for every cat lover.

What is Nekopopi.care?

A Comprehensive Approach to Cat Care

Nekopopi.care is more than just an online store—it’s a comprehensive platform designed to cater to every aspect of your cat’s health and well-being. From nutrition to accessories, Nekopopi.care offers an extensive range of products that help keep your cat content and comfortable.

One of the core values of nekopopi.care is its commitment to quality. All the products featured on the platform are selected for their premium ingredients, safety, and functionality, ensuring that your cat gets the best of the best.

Product Categories at Nekopopi.care

Cat Food and Treats

Nutrition is one of the most important factors in keeping your cat healthy. At nekopopi.care, you’ll find a variety of premium cat food options, ranging from wet food to dry kibble, to suit your cat’s dietary preferences and needs. With high-quality protein sources, added vitamins, and minerals, each product is designed to support your cat’s health.

But it’s not just about the meals. Nekopopi.care also offers a selection of healthy treats, perfect for rewarding your cat in between meals.

Cat Toys and Accessories

Cats love to play and stay entertained. Nekopopi.care provides a wide variety of fun and engaging toys, from interactive playthings to puzzle toys that challenge your cat’s intellect. These toys are designed to keep your cat physically active and mentally stimulated.

In addition to toys, nekopopi.care has a fantastic range of accessories, including scratching posts, beds, and carriers. These items not only enhance your cat’s comfort but also help in preventing damage to your furniture.

Cat Health and Wellness

The health and wellness section at nekopopi.care covers everything from grooming tools to supplements. Regular grooming helps prevent matting and keeps your cat’s coat shiny and healthy. You’ll also find flea treatments, grooming brushes, and even special shampoos designed specifically for cats.

Additionally, Nekopopi.care offers a range of supplements, including vitamins and joint health support, to keep your cat feeling its best.

Cat Litter and Hygiene

Keeping your cat’s litter box clean is essential for both its health and your home’s hygiene. Nekopopi.care offers a range of high-quality cat litter options, including natural and eco-friendly choices. These products help absorb odors and are gentle on your cat’s paws.

You’ll also find litter accessories such as scoops and liners, ensuring a hassle-free experience for both you and your cat.

Why Choose Nekopopi.care?

Experience and Expertise

Nekopopi.care stands out due to its years of expertise in the pet care industry. The platform is curated by a team of experts who are passionate about providing the best care for cats. Their deep understanding of feline behavior, health, and nutrition helps them choose the highest-quality products available.

With a focus on customer satisfaction, Nekopopi.care goes above and beyond to provide valuable information about each product, including detailed descriptions and ingredients. This ensures that pet owners can make informed decisions for their beloved cats.

High-Quality, Safe Products

When it comes to your pet’s health, safety is paramount. That’s why nekopopi.care sources only the safest, most reliable products on the market. Every product is carefully vetted to ensure it meets the highest standards for safety and quality. From food to grooming supplies, you can rest assured that your cat is in good hands.

Convenient Online Shopping Experience

One of the key advantages of shopping at nekopopi.care is the user-friendly online shopping experience. Whether you’re ordering a new toy or restocking your cat’s food, the website’s easy-to-navigate interface ensures a smooth shopping experience. Plus, with fast delivery options, you can get your cat’s essentials delivered right to your door.

Customer Reviews: What Are People Saying About Nekopopi.care?

Trust and Reputation

Nekopopi.care has built a loyal customer base over the years, thanks to its dedication to quality and service. Many satisfied customers rave about the exceptional products and fast, friendly customer service. Whether it’s finding the perfect cat food or dealing with an issue promptly, nekopopi.care has earned a reputation for reliability and trustworthiness.

Here are just a few reviews from happy customers:

- “I’ve been buying my cat’s food from Nekopopi.care for months now, and I’ve never been disappointed. The quality is fantastic, and my cat loves it!”

- “Nekopopi.care has everything I need for my cats. The toys are so fun, and they keep my kitties entertained for hours!”

Tips for Choosing the Right Products for Your Cat

Understand Your Cat’s Needs

When shopping at nekopopi.care, it’s important to consider your cat’s age, breed, and health condition. For example, kittens have different nutritional needs compared to adult cats, and senior cats may require specialized care products. Nekopopi.care offers a wide selection of products that cater to various life stages, ensuring that your cat gets exactly what it needs.

Consult with Your Veterinarian

Before making any significant changes to your cat’s diet or introducing new wellness products, it’s always a good idea to consult with your veterinarian. They can provide valuable insights and recommendations based on your cat’s health history.

Conclusion

Nekopopi.care has quickly become a trusted name in the world of premium cat care products. With its wide range of carefully selected items, including food, toys, health products, and accessories, Nekopopi.care makes it easy to provide your cat with the best care possible. Whether you’re a new cat owner or have been caring for cats for years, Nekopopi.care is the one-stop shop for all your feline needs.

By choosing nekopopi.care, you’re not just purchasing products—you’re investing in your cat’s happiness and well-being. Explore the range of products today, and give your furry friend the care they deserve!

Blogs

Exploring Serge Fondja’s Influence: NSMC and His Impact on Facebook

Introduction

In today’s digital age, Facebook has become more than just a social platform; it is a space where ideas, innovations, and personalities converge to shape global conversations. Among the prominent figures making waves on this platform is Serge Fondja, a thought leader whose involvement with the National Social Media Council (NSMC) is creating ripples across the social media landscape. With an extensive background in digital strategy, marketing, and social media management, Serge Fondja’s impact on Facebook and his collaboration with NSMC have contributed to how brands and individuals engage on this platform.

This article takes an in-depth look at Serge Fondja’s career, his work with NSMC, and how his presence on Facebook is influencing online trends, interactions, and marketing strategies. From his personal journey to his professional insights, we will explore the ways Serge is helping to shape the future of social media engagement and brand-building on Facebook.

Who is Serge Fondja?

Early Life and Career Beginnings

Serge Fondja’s journey into the world of social media and digital strategy is one marked by passion and foresight. His early career was steeped in the realms of technology and communications, where he developed a strong understanding of digital ecosystems. As a young professional, Serge’s keen interest in social media trends and user behavior soon led him to pursue a career that would eventually see him influencing how businesses and individuals use platforms like Facebook to connect and engage.

Over the years, Serge has honed his skills in digital marketing, social media analytics, and content creation. His approach to these areas combines a unique blend of creativity and technical proficiency, which has allowed him to stay ahead of the curve in an ever-evolving industry. His early career choices and growing expertise ultimately led him to become a key figure within NSMC, a group dedicated to enhancing social media strategies and promoting best practices.

Serge Fondja’s Role at NSMC

As a member of the National Social Media Council (NSMC), Serge Fondja’s role extends far beyond that of a conventional digital marketer. NSMC is a prominent body that advocates for responsible and effective social media practices, especially on major platforms like Facebook. Serge’s expertise in understanding user engagement and content virality has allowed him to play a pivotal role in NSMC’s initiatives, focusing on building a healthier, more engaged digital community.

His role within NSMC involves advising on content strategies, user engagement metrics, and the ethical use of social platforms. His influence has helped shape guidelines and policies aimed at improving brand transparency and user trust on platforms like Facebook, where the line between personal and professional interactions is often blurred. Serge’s efforts have also contributed to the development of strategies that help businesses leverage Facebook’s tools for optimal audience engagement and conversions.

The Influence of Serge Fondja on Facebook

Using Facebook for Brand Engagement

Serge Fondja’s expertise has significantly contributed to how businesses engage with their target audience on Facebook. Through his work at NSMC, Serge has developed strategies that focus on authenticity, storytelling, and community-building—elements that are essential for successful social media marketing. Brands leveraging his insights have been able to create more meaningful and lasting relationships with their audiences, standing out in a crowded digital space.

The key to Serge’s approach lies in his understanding of Facebook’s unique features, such as its powerful advertising tools, group functionalities, and community-building aspects. He encourages brands to use Facebook not just as a marketing platform, but as a space for fostering real-time interactions with their customers. His recommendations emphasize the importance of creating content that resonates with the audience on a personal level, encouraging conversation, feedback, and loyalty.

Facebook as a Platform for Thought Leadership

One of the most compelling aspects of Serge Fondja’s presence on Facebook is his role as a thought leader. Through his posts, articles, and public discussions, Serge has built a following of like-minded professionals, marketers, and digital enthusiasts who look to him for advice and insights into the future of social media marketing. His content often explores trending topics in digital marketing, new features on Facebook, and predictions for the evolution of the social media landscape.

Serge’s thought leadership on Facebook is not just about promoting strategies; it’s about fostering a mindset that encourages innovation and forward-thinking. His followers benefit from his extensive knowledge of Facebook’s algorithms, ad strategies, and user engagement techniques, gaining a competitive edge in the digital marketing world. Through his consistent posts, Serge has established himself as a go-to resource for anyone looking to understand the deeper workings of Facebook and its potential for business growth.

The Role of NSMC in Shaping Social Media

NSMC’s Vision for Facebook

The National Social Media Council (NSMC) plays a critical role in shaping the digital strategies of businesses and influencers on platforms like Facebook. NSMC’s mission is to create a safer, more transparent social media environment by establishing best practices and ethical guidelines. Serge Fondja, in his capacity at NSMC, contributes to this vision by advocating for policies that encourage responsible content creation and fair advertising practices on Facebook.

One of the key areas that NSMC focuses on is the protection of user data and privacy, which is of utmost importance in today’s digital age. By collaborating with Facebook and other platforms, Serge and NSMC ensure that marketers and businesses are aware of the ethical implications of data usage and advertising strategies. This focus on user safety and trust has been instrumental in maintaining the credibility and reputation of Facebook as a platform for both personal and professional use.

NSMC’s Role in Promoting Digital Literacy

NSMC’s work extends beyond just policy creation; the council is also dedicated to promoting digital literacy. Serge Fondja’s involvement in this aspect of NSMC’s mission has helped bridge the gap between social media marketing professionals and everyday users, ensuring that both groups understand the tools, features, and potential risks associated with platforms like Facebook.

Through educational programs, webinars, and public campaigns, NSMC strives to increase awareness about the importance of ethical social media practices. Serge’s input has been vital in shaping these programs, ensuring that they are accessible, informative, and actionable for a wide audience. As a result, both businesses and individual users are better equipped to navigate the complexities of social media, especially when it comes to using Facebook effectively for personal branding and business marketing.

Conclusion

Serge Fondja’s work with the National Social Media Council (NSMC) and his influence on Facebook have made him a significant figure in the digital marketing world. Through his strategic insights, thought leadership, and commitment to promoting responsible social media practices, Serge has shaped how brands and individuals use Facebook to engage with their audiences. His contributions to the field are not only valuable for marketers but also for users who seek a more meaningful and ethical online experience.

In a world where Facebook continues to evolve, Serge Fondja’s expertise will remain pivotal in helping businesses, influencers, and individuals navigate the platform’s complexities. As NSMC continues to influence social media practices, Serge’s work will play a critical role in fostering an online space where engagement is authentic, interactions are meaningful, and businesses thrive.